Check your paper for grammar and plagiarism

Catch plagiarism and grammar mistakes with Chegg's paper checker

The papers you upload will be added to our plagiarism database and will be used internally to improve plagiarism results.Cite smarter, worry less with Cite This For Me™ Premium

Upgrade to save your work, check for plagiarism, and more!

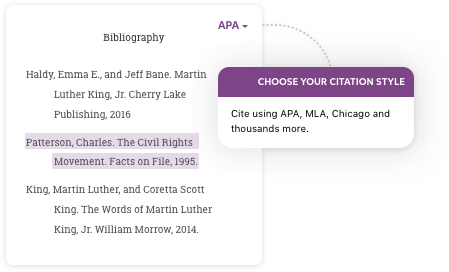

- References

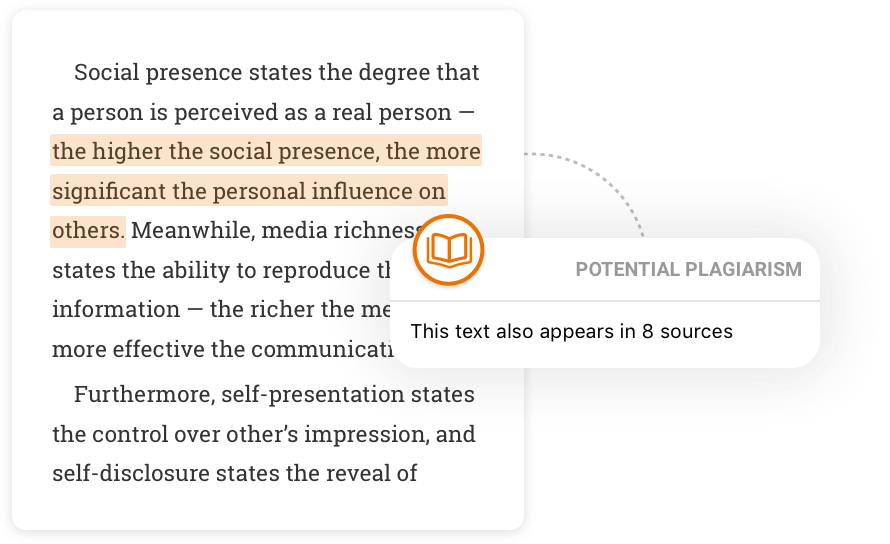

- Plagiarism

Cite sources the easy way

Easily create references with our citation generator for 50+ source types.

Get startedChoose your online writing help

Cite smarter, worry less with Cite This For Me Premium

Upgrade to save your work, check with plagiarism, and more!

Learn MoreWelcome to Cite This For Me™

About Cite This For Me™

Cite This For Me™ was launched in October 2010, we began with the mission of helping students quickly create citations. Since then, the Cite This For Me™ citation generator has assisted millions of students across the world including in the United Kingdom, Canada, United States, Australia, and beyond.

Our tools are designed to help you quickly prepare an entire bibliography or reference list. Even if you know very little about references, our forms and automatic citation features can help guide you through the process and tell you what information is needed. This means less guessing for you and an easier citation process!

Nearly any style you can think of is supported by the Cite This For Me™ citation generator, including Harvard referencing, APA (American Psychological Association) style, MLA (Modern Language Association) style, Chicago style, Vancouver, and thousands of others.

Why citing matters

Citing isn’t something you usually think about, but it’s important nonetheless. You already do it in your everyday life without realising it. Have you ever said, “I heard on XYZ News that . . . “, or “I read in XYZ that those two celebrities are dating”, or even “Mom said that you can’t do that”. By saying where you got your information, you are casually citing a source.

We do this because it gives credibility to what we say, but also because it credits the originator of the information. It also allows others to follow up if they need more information. Formal citing done for papers and projects takes this a step further. In addition to the reasons mentioned above, citing sources in academia provides evidence of your research process and helps you avoid plagiarism.

Plagiarism is a word you never want to hear describing your work. You’ve probably seen headlines in the news and heard stories in school about the negative consequences of plagiarism. It’s not good but it is preventable. By creating references and citations with Cite This For Me™ tools you’re taking steps to help avoid this.

Start citing easily with Cite This For Me™

Click the button “Create citations” to begin. You’ll be prompted to choose a source type and guided through the rest of the citing process. For source types like websites, journal articles, and books, the Cite This For Me™ citation generator automatically tries to find your source’s information based on details you provide. That could be anything from the author’s name to the source’s URL to the article’s DOI number. This makes citing more efficient and helps you easily create references and citations for your paper in a timely manner.

Citation guides: Understanding it all

Beyond simply creating references or citations, most citation styles have additional guidelines about paper formatting, in-text citations, and other details. Cite This For Me™ citation guides cover a lot of this additional information, so your paper is more properly prepped and less likely to get points taken off for these details. The guides cover several citation styles, but the most popular are Harvard referencing, APA format, MLA format, and Chicago style.

Looking for more? Check out Cite This For Me™ Premium

A good paper references several sources. Multiply that with the several papers most schools assign in a year, and you get dozens of sources that will need to be cited within your academic career. That’s a lot of references to create, sort through, and keep track of.

That’s where Cite This For Me™ Premium comes in. With a premium account you can cite as many sources as you want, organize the sources into bibliographies, and save ALL of those bibliographies so you can easily refer back to your references. It’s a great way to manage your bibliographies and cite with confidence.